Some Highlights: November’s Existing Home Sales report revealed that sales are now at an annual pace of 5.61 million which is “now the highest since February 2007 (5.79 million) and is 15.4% higher than a year ago (4.86 million).” Total housing inventory (or the inventory of homes for sale) fell 8.0% from last month and […]

The Fed Raised Rates: What Does that Mean for Housing?

You may have heard that the Federal Reserve raised rates last week… But what does that mean if you are looking to buy a home in the near future? Many in the housing industry have predicted that the Federal Open Market Committee (FOMC), the policy-making arm of the Federal Reserve, would vote to raise the […]

Student Loans = Higher Credit Scores

According to a recent analysis by CoreLogic, Millennial renters (aged 20-34) who have student loan debt also have higher credit scores than those who do not have student loans. This may come as a surprise, as there is so much talk about student loans burdening Millennials and holding them back from many milestones that previous […]

Whether You Rent or Buy: Either Way You’re Paying a Mortgage

There are some renters who have not yet purchased a home because they are uncomfortable taking on the obligation of a mortgage. Everyone should realize that, unless you are living with your parents rent free, you are paying a mortgage – either yours or your landlord’s. As an owner, your mortgage payment is a form […]

Trends: Follow the demographics and focus on seniors

More small business owners are relocating to states like Florida to tap into an expected surge of baby boomers who are longing for warm climate retirement. Source: Florida Realtors

2 Tips to Ensure You Get the Most Money When Selling Your House

Every homeowner wants to make sure they get the best price when selling their home. But how do you guarantee that you receive maximum value for your house? Here are two keys to ensuring you get the highest price possible. 1. Price it a LITTLE LOW This may seem counterintuitive. However, let’s look at this […]

With Fed hike done deal, economists eye next one

All things being equal – meaning the U.S. economy keeps improving and new batches of data prove it – the Fed might raise short-term interest rates again in March. Source: Florida Realtors

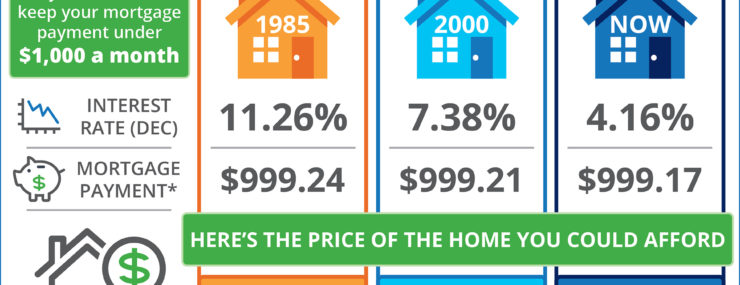

The Impact Your Interest Rate Has on Your Buying Power [INFOGRAPHIC]

Some Highlights: Your monthly housing cost is directly tied to the price of the home you purchase and the interest rate you secure for your mortgage. Over the last 30 years, interest rates have fluctuated greatly with rates in the double digits in the 1980s, all the way down to the near 4% we are […]

Why You Shouldn’t Take Your House Off the Market During the Holidays

If you are one of the many homeowners who is debating taking your home off the market for the next few weeks, don’t! You will miss the great opportunity you have right now! The latest Existing Home Sales Report from The National Association of Realtors (NAR), revealed that the inventory of homes for sale has […]

30-year mortgage rate rises again – to 4.16%

It’s the seventh week in a row for increases, and two out of three mortgage experts polled this week predict they’ll continue to rise over the short term. Source: Florida Realtors

- « Previous Page

- 1

- …

- 194

- 195

- 196

- 197

- 198

- …

- 227

- Next Page »