Whenever there is talk about an improving housing market, some begin to show concern that we may be headed toward another housing bubble that will be followed by a crash similar to the one we saw last decade. Here are five data points that show the housing market will continue to recover, and that a […]

Ready to Make an Offer? 4 Tips for Success

So you’ve been searching for that perfect house to call a ‘home’ and you finally found one! The price is right, and in such a competitive market you want to make sure you make a good offer so that you can guarantee your dream of making this house yours comes true! Freddie Mac covered “4 […]

76% Of US Homeowners Now Have at Least 20% Equity in Their Homes!

CoreLogic’s latest Equity Report revealed that 91.1% of all mortgaged properties are now in a positive equity situation, while 75.9% now have significant equity (defined as more than 20%)! The report also revealed that 548,000 households regained equity in the second quarter of 2016 and are no longer under water. Price Appreciation = Good News for Homeowners Frank […]

Don’t Underestimate the Importance of Using an Agent When Selling Your Home

When a homeowner decides to sell their house, they obviously want the best possible price with the least amount of hassles. However, for the vast majority of sellers, the most important result is to actually get the home sold. In order to accomplish all three goals, a seller should realize the importance of using a […]

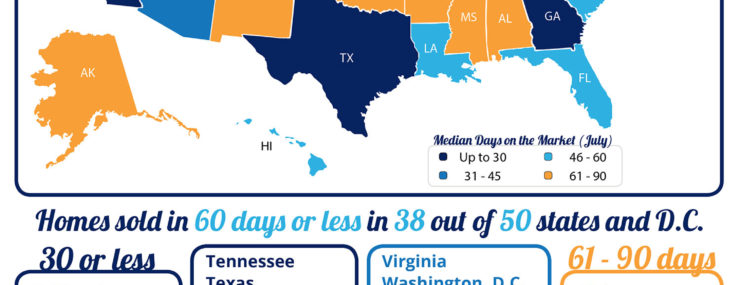

50% of Houses Sold in 36 Days or Less in July [INFOGRAPHIC]

Some Highlights: The National Association of REALTORS® surveyed their members for their Confidence Index The REALTORS® Confidence Index is a key indicator of housing market strength based on a monthly survey sent to over 50,000 real estate practitioners. Practitioners are asked about their expectations for home sales, prices and market conditions. Homes sold in less […]

The Cost of NOT Owning Your Home

Owning a home has great financial benefits. Because of this, more and more experts are growing concerned about the ramifications of a falling homeownership rate. Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed. The […]

Mortgage Standards Easing TOO MUCH? NO!!

There is no doubt that getting a mortgage is easier today than it was right after the housing crash a decade ago. However, the easing of credit availability has led to some questioning of whether or not we are headed for another housing crisis. Let’s put everything into the proper perspective. Mortgage Credit Availability Over […]

Why Getting Pre-Approved Should Be Your First Step

In many markets across the country, the amount of buyers searching for their dream homes greatly outnumbers the amount of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved […]

Interest Rates Remain at Historic Lows… But for How Long?

The interest rate you pay on your home mortgage has a direct impact on your monthly payment; The higher the rate, the greater your payment will be. That is why it is important to look at where the experts believe rates are headed when deciding to buy now or wait until next year. The 30-year […]

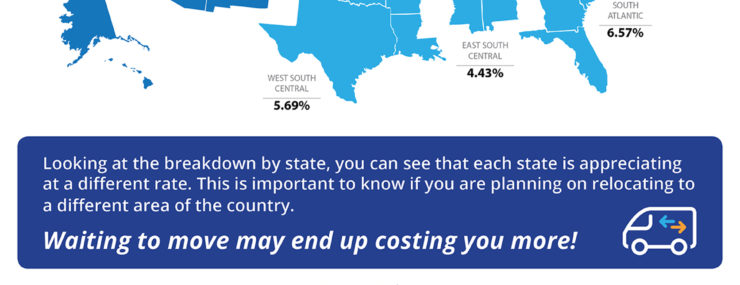

Home Prices Up 5.61% Across The Country! [INFOGRAPHIC]

Some Highlights: The Federal Housing Finance Agency (FHFA) recently released their latest Quarterly Home Price Index report. In the report, home prices are compared both regionally and by state. Based on the latest numbers, if you plan on relocating to another state, waiting to move may end up costing you more! Vermont was the only one state where home […]

- « Previous Page

- 1

- …

- 68

- 69

- 70

- 71

- 72

- …

- 81

- Next Page »