It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their homes on the market until then. The question is whether or not that will be a good strategy this year. The other listings that do come out in the spring […]

Buying a Home is More Affordable Than Renting in 66% of US Counties

According to ATTOM Data Solutions’ 2017 Rental Affordability Report, buying a home is more affordable than renting in 354 of the 540 U.S. counties they analyzed. The report found that “making monthly house payments on a median-priced home — including mortgage, property taxes and insurance — is more affordable than the fair market rent on […]

How Low Interest Rates Increase Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.09%, which is still very low in comparison to recent history! The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power. Purchasing power, simply put, is […]

Have You Saved Enough for Closing Costs?

There are many potential homebuyers, and even sellers, who believe that they need at least a 20% down payment in order to buy a home or move on to their next home. Time after time, we have dispelled this myth by showing that many loan programs allow you to put down as little as 3% […]

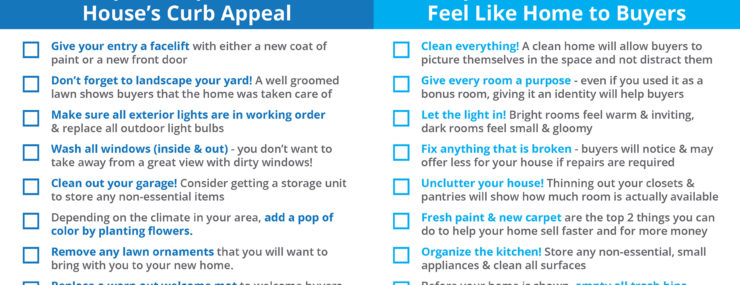

Tips for Preparing Your House For Sale [INFOGRAPHIC]

Highlights: When listing your house for sale your top goal will be to get the home sold for the best price possible! There are many small projects that you can do to ensure this happens! Your real estate agent will have a list of specific suggestions for getting your house ready for market and is […]

Will Housing Affordability Be a Challenge in 2017?

Some industry experts are saying that the housing market may be heading for a slowdown in 2017 based on rising home prices and a jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR). Here is how NAR defines […]

What Would a Millennial Baby Boom Mean for Housing?

Recently released data from the National Center for Health Statistics revealed that 1.3 million Millennial women gave birth for the first time in 2015. There are now over 16 million women in this generation who have become mothers. “All told, Millennial women (those born between 1981 to 1997) accounted for about eight in ten (82%) […]

5 Myths About Real Estate Reality TV Explained

Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV binge session? We’ve all been there… watching entire seasons of “Love it or List it,” “Fixer Upper,” “House Hunters,” “Property Brothers,” and so many more, just in one sitting. When you’re in the middle of your […]

Why Pre-Approval Should Be Your First Step

In many markets across the country, the number of buyers searching for their dream homes greatly outnumbers the amount of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved […]

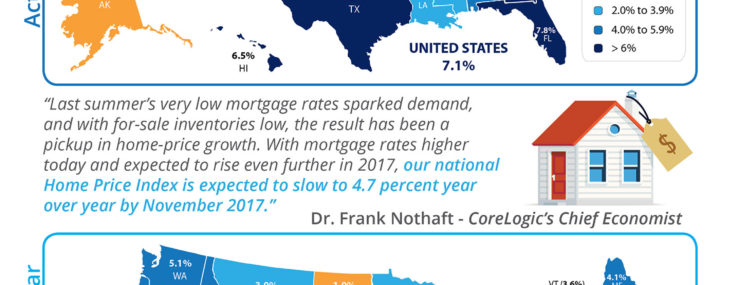

Prices Rose 7.1% Year-Over-Year [INFOGRAPHIC]

Some Highlights: CoreLogic’s latest Home Price Index shows that prices rose by 7.1% across the United States year-over-year. With mortgage interest rates rising in the short term, CoreLogic believes price appreciation will slow to 4.7% by this time next year. 49 out of 50 states, and the District of Columbia, all had positive appreciation over […]

- « Previous Page

- 1

- …

- 59

- 60

- 61

- 62

- 63

- …

- 81

- Next Page »