The U.S. Supreme Court ruled Tue. that property owners can file a lawsuit against the U.S. Army Corp of Engineers if they disagree with its land-use decisions. Source: Florida Realtors

How Does Housing Help Build Family Wealth?

As the economy continues to improve, more and more Americans are seeing their personal financial situations also improving. Instead of just getting by, many are now beginning to save and find other ways to build their net worth. One way to dramatically increase their family wealth is through the acquisition of real estate. For example, […]

Banks rush to offer 3% downpayment loans

If one major bank starts to offer 3% downpayment loans, others often follow. So far, Wells Fargo, Chase and BofA are offering non-FHA, low-downpayment products. Source: Florida Realtors

All Gave Some. Some Gave All.

Source: Luxury Market News

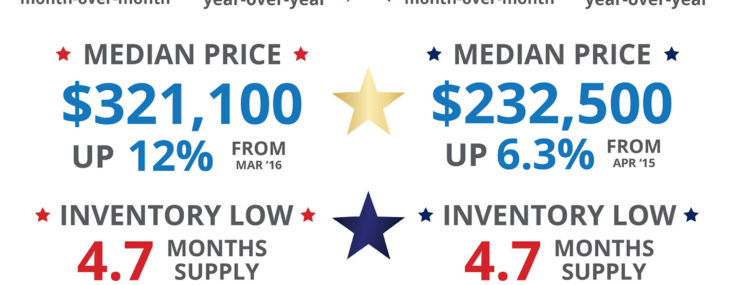

New & Existing Home Sales Climb [INFOGRAPHIC]

Some Highlights: Both New Home Sales and Existing Home Sales are up month-over-month and year-over-year. Inventory remains low which continues to drive home prices up as demand continues to exceed the 4.7-month inventory. The median price of new homes is up 12% from March 2015, while the median price of existing homes is up 6.3% from April […]

Unparalleled Trust Necessary Before Listing Your House

You and your family have decided to sell your house. It is now time to choose a real estate professional to help with the process. One of the major attributes this agent must possess is trustworthiness. To what degree do you need to trust them? You must have enough trust in them that you feel […]

NAR: Pending home sales at a 10-year high

Consumers are buying homes. NAR’s monthly gauge of homes under contract rose for the third straight month in April to a level not seen since Feb. 2006. Source: Florida Realtors

Sell NOW Before Competition Hits the Market

In their current edition of the Home Price Expectation Survey released last week, Pulsenomics asked this question of the 100+ economists, real estate experts and investment & market strategists they surveyed: “In your opinion, what is the primary driver of recent home value growth in the U.S.?” Here are the top four reasons given by […]

Credit score problems still haunt Americans

The first thing buyers should do? Check credit scores. CFPB says that a lot of consumers still complain about mistakes and trouble with getting them corrected. Source: Florida Realtors

Where Are Home Values Headed Over the Next 5 Years?

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey. Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts and investment & market strategists about where they believe prices are headed over the next five years. They […]

- « Previous Page

- 1

- …

- 245

- 246

- 247

- 248

- 249

- …

- 255

- Next Page »