HUD switched direction. It now says it will look for cases where lenders failed to fully inform FHA buyers on loan terms, charged improper fees or used coercion. Source: Florida Realtors

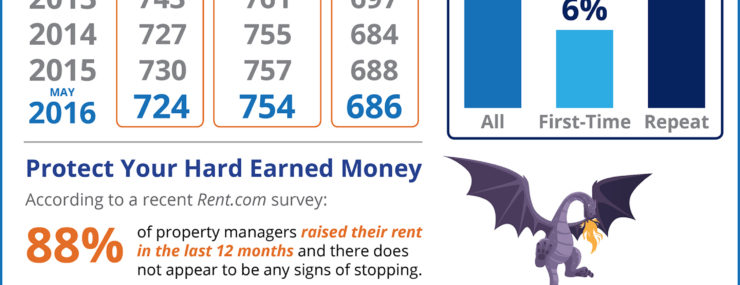

Slaying Myths About Home Buying [INFOGRAPHIC]

Some Highlights: Interest Rates are still below historic numbers. 88% of property managers raised their rent in the last 12 months! Credit score requirements to be approved for a mortgage continue to fall. Source: Luxury Market News

Baby Boomers Are On the Move

According to a Merrill Lynch study, “an estimated 4.2 million retirees moved into a new home last year alone.” Two-thirds of retirees say that they are likely to move at least once during retirement. As one participant in the study stated: “In retirement, you have the chance to live anywhere you want. Or you can just stay […]

Housing is for everyone – no exceptions

At NAR’s “Housing for All” symposium this week, NAR VP and Floridian Sherri Meadows said that while homelessness is down, “housing insecurity” is on the rise. Source: Florida Realtors

Rents Skyrocket at Highest Rate in almost a Decade

The Consumer Price Index (CPI) was released by the Labor Department last week. An analysis by Market Watch revealed the cost of rent was 3.8% higher than a year ago for the second straight month in June. That’s the strongest yearly price gain since 2007. This coincides with a report released earlier this month in […]

Green energy boost: FHA to back some PACE mortgages

FHA says it will now approve purchase and refinance mortgage applications in states that treat clean-energy program (PACE) funding as a special assessment that homeowners pay like property taxes. Source: Florida Realtors

A Homeowner’s Net Worth is 45x Greater Than a Renter’s!

Every three years, the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400). In a Forbes article, the National Association of Realtors’ (NAR) Chief Economist Lawrence Yun predicts that in […]

3 Questions Every Buyer Should Ask Themselves

If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interest at heart, they may not be fully aware of your needs and what is currently happening in the real estate market. Answering the following 3 questions will help […]

More homes at risk of storm surge

CoreLogic: Fla. remains the state with the most homes (2.7M) at risk for hurricane storm surge and with the highest reconstruction cost ($535.6B) in the U.S. Source: Florida Realtors

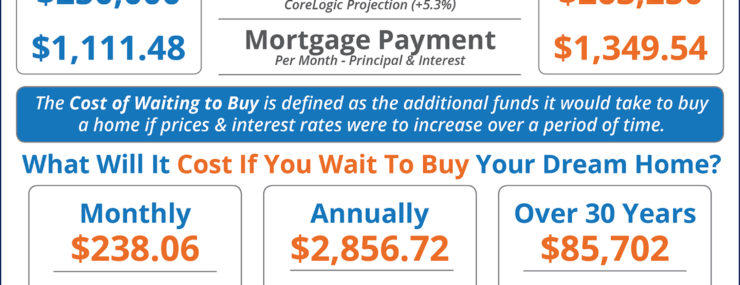

Should I Wait Until Next Year? Or Buy Now? [INFOGRAPHIC]

Some Highlights: The Cost of Waiting to Buy is defined as the additional funds it would take to buy a home if prices & interest rates were to increase over a period of time. Freddie Mac predicts interest rates to rise to 4.6% by next year. CoreLogic predicts home prices to appreciate by 5.3% over […]

- « Previous Page

- 1

- …

- 239

- 240

- 241

- 242

- 243

- …

- 255

- Next Page »